Overview

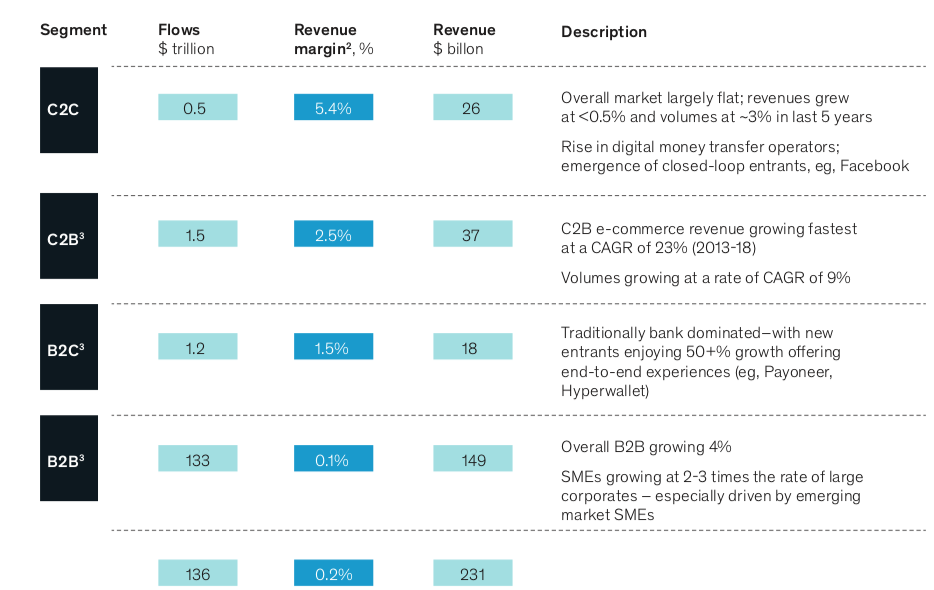

Cross-border payment flow worldwide: $136 trillion (2018 by McKinsey):

- 97.8% volume was B2B payment

- 64.8% revenue from B2B payment

- C2C has highest fee (5%)

- $15 billion was crypto-powered (i.e. 0.01%)

Crypto Payment vs. Correspondent Bank

- Shorter settlement period

- Lower cost

However,

- Volatility of value

- Fiat onramp and offramp

- Complicated UX

- Only have regional unicorns (bcuz offramp and BD to enroll users is a highly localized task)

Alternatives Payment Types

- Peer-to-peer marketplace -> on/offramp network

- Big band gift cards -> stablecoins

New start-ups (non-crypto) including m-Pesa, Transferwise, Paypal and Veem.

Crypto Start-ups

BitPay

Payment processor, fiat onramp and offramp, it supports settlement in 8 currencies.

Cost-wise, BitPay charges receivers a 1% flat fee.

Takes 1 hour for crypto settlement, 2 days for US domestic fiat settlement.

Processed $1 Billion in 2018.

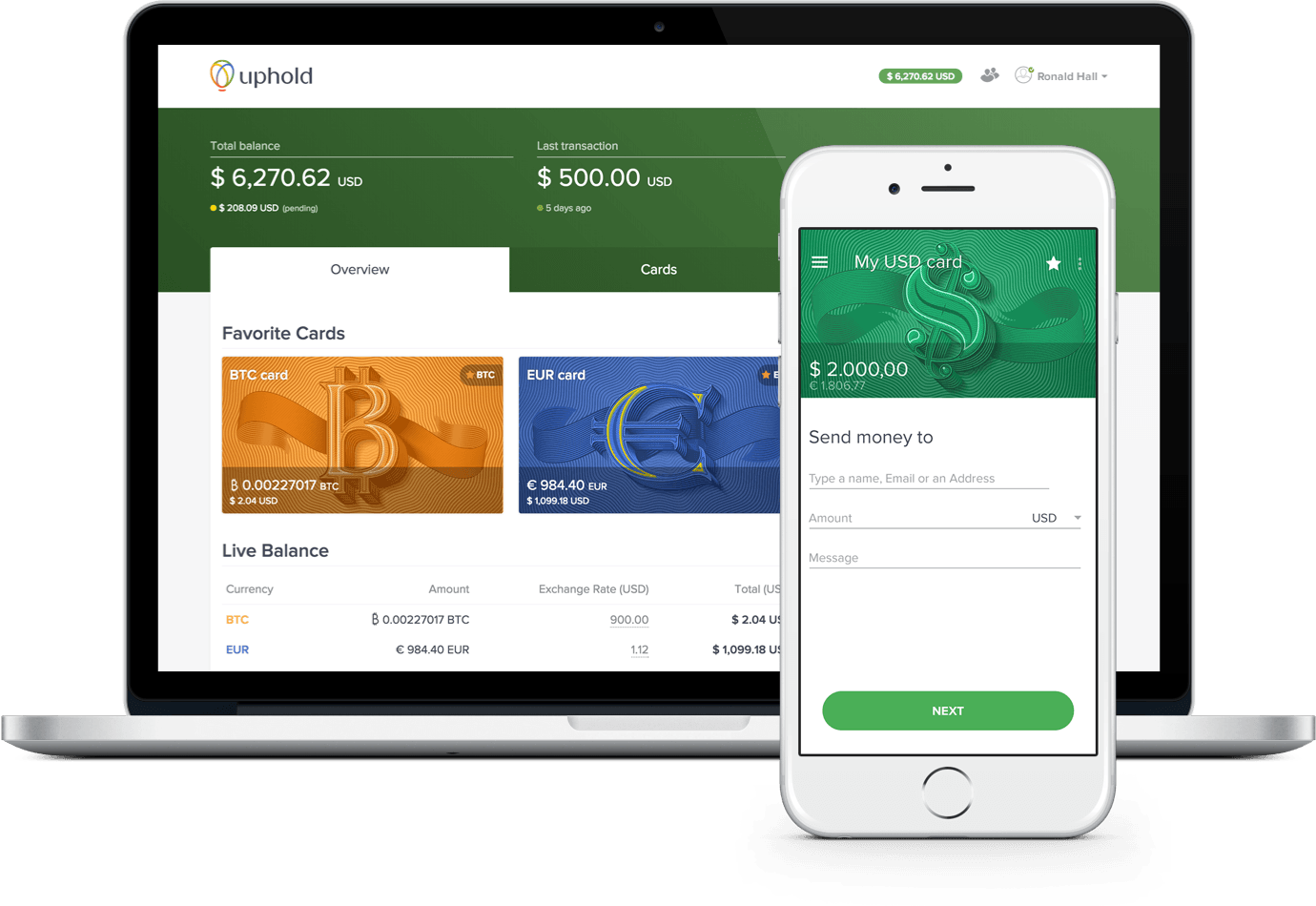

Uphold, San Francisco

Payment APIs and SDKs, and issues stable tokens through Universal Protocol Alliance.

Also offer crypto lending and borrowing through 3rd party.

Since 2015, Uphold has powered $4 billion transactions.

Wirex, UK

B2C and B2B

Supporting 9 cryptocurrencies and 11 fiat currencies via:

- a visa debit card

- a digital wallet

- newly launched Stellar-based token WRX

- crypto on/offramp such as ACH, SEPA, SWIFT etc

Processed $2 billion transactions as of 2019.

The focus was global retail e-commerce market.

Will offer savings account and crypto-backed loans in the near future

Coinify, Denmark

Enables merchants to accept blockchain payments

over 30,000 businesses signed up

Coinify focuses on 2B clients, estimated annual revenue $7 million.

Wyre, San Francisco

Fiat onramps API for crypto businesses.

completes transactions in less than 6 hours, charging less than 1%.

Also offers OTC crypto trading services

Usecases:

- enables GoLance for BTC payouts

- provide Opennode with BTC to Fiat merchant settlements

- enables Shapeshift, and BRD for buying/selling Bitcoin with ACH

Completed over $750 million in bank-to-bank FX payments.

Terra

ICO in 2018. Instant settlement and low transaction fees on its own chain.

Process over $850K on a daily basis through 650,000 users.

Launched stable token in Meme pay, a popular messenger app in Mongolia.

Users can also use KRT, the Terra’s KRW stable coin, to borrow BTC and ETH.

Paxful

Bitcoin OTC platform, processes $25 million Bitcoin trading weekly.

cross-border payment may not only be solved by payment processors, but also by peer-to-peer marketplace with an extension onramp offramp options

has over traded about $1 billion BTC in 2019.

“2/3 of USD volume is actually attributable to USD denominated gift card trading.”

Reference

https://medium.com/blockchain4all/crypto-powered-cross-border-payment-2-2-1f5ad4f2043e

https://swiftinstitute.org/wp-content/uploads/2018/10/SIWP-2017-001-The-Future-of-Correspondent-Banking_FINALv2.pdf